Dr. Satyendra Timilsina

Financial Stability can be viewed as a state in which the financial system is resilient enough to absorb shocks and recover from stressful situations. It requires a healthy financial system that is capable of performing at all times without hurdles and hindrances. According to the World Bank, the true value of financial stability is best illustrated in its absence, in periods of financial instability. During these periods, banks are reluctant to finance profitable projects, asset prices deviate excessively from their intrinsic values, and payments may not arrive on time. Major instability can lead to bank runs, hyperinflation, or a stock market crash. It can severely shake confidence in the financial and economic system.

What is a financial system?

Ensuring financial stability requires not only sound financial institutions, but also a well-developed financial market and financial infrastructure. Therefore, understanding the concept of financial system is key to developing insights into financial stability. Financial system, in a broader sense, comprises three components: Financial Institutions, Financial Markets and Financial Infrastructure.

Financial institutions are the key players in the financial system as they provide financial intermediation. They mobilize savings and allocate them for productive uses. While Banks and Financial Institutions are involved both in deposit mobilization and credit creation, contractual saving institutions and insurance companies help mobilize funds in the financial market. The Financial Soundness Indicators (FSI): Compilation Guide by the International Monetary Fund (IMF) states: “The role of financial institutions within the system is primarily to intermediate between those that provide funds and those that need funds, and typically involves transforming and managing risk. Particularly for a deposit taker, this risk arises from its role in maturity transformation, where liabilities are typically short term (for example, demand deposits), while its assets have a longer maturity and are often illiquid (for example, loans).”

Financial market provides alternatives for raising funds and investment. A good financial system includes a well-developed financial market consisting of financial instruments capable of managing risks. Financial markets provide a forum within for trading financial claims and provides protection against adverse price movements to facilitate the management and transformation of risks. They help match savers and investors through the issuance of short-term and long-term financial instruments. A well-developed financial market allows investors to adjust their portfolios according to changing economic and financial conditions, mainly to reduce risks and ensure stable returns. An interaction between demand and supply of the financial instruments is key to determining their prices.

The third component of financial system, financial infrastructure is equally important as it provides platform for the smooth operation of financial institutions and markets. Financial infrastructure could be privately or publicly owned. It includes institutions responsible for payments and settlement of financial transactions, providing technical and legal infrastructure, accounting standards, regulation, supervision, and financial surveillance. While guaranteeing cyber-security that can protect system networks, it restricts access to critical information and provides data protection as key area for sound financial infrastructure. Well-defined systems for dispute management, consumer protection, judicial infrastructure, accounting standards, and regulatory frameworks are equally important. A well-developed financial infrastructure helps build confidence in the financial system and brings in more players, thereby ensuring fair market operation.

Financial system and financial stability

Sound financial institutions, smooth market transactions and a well-structured financial infrastructure ensure that the financial system is strong enough to absorb shocks during difficult times, assuring financial stability in the economy. “It is considered stable when financial institutions and financial markets are able to provide households, communities, and businesses with the resources, services, and products they need to invest, grow, and participate in a well-functioning economy. To support financial stability, it is critical that financial institutions and market structures are resilient, so that they are able to bend but not break under extreme economic pressures. Financial stability depends on firms and critical financial market structures having the financial strength and operational skills to manage through volatility and continue to provide their essential products and services to consumers, communities, and other businesses (Federal Reserve)”.

Why does the soundness of financial institutions matter?

Financial institutions play a pivotal role in the financial system. Unlike other private businesses, they operate largely with public money – the share of public money that they mobilize is significantly larger than that of investors. Any mismanagement of funds or inefficiency within these institutions can result in the loss of public money, thereby destabilizing the financial sector.

The FSI compilation guide of the IMF states, “Within a financial system, the role of deposit takers is central. They often provide a convenient location for the placement and borrowing of funds and, as such, are a source of liquid assets and funds to the rest of the economy. They also provide payments services that are relied upon by all other entities for the conduct of their business. Thus, failures of deposit takers can have a significant impact on the activities of all other financial and nonfinancial entities and on the confidence in, and the functioning of, the financial system as a whole. This makes the analysis of the health and soundness of deposit takers central to any assessment of financial system stability”.

Soundness of financial institutions

Soundness of the financial institution is assessed from three different aspects: solvency, liquidity and profitability. Solvency refers to an institution’s capability to meet long term obligations. A financial institution with strong solvency indicator is capable to absorb shocks and operate smoothly over the long term. Adequate liquidity provides confidence that the institution will meet immediate payments and manage fund withdrawals. Profitability condition is essential for a business to conduct further business. Adequate profitability encourages expansion and helps institution maintain service coverage and quality.

The IMF’s Financial Soundness Indicators for deposit taking institutions include 17 core indicators and 12 additional indicators. There is one core indicator for real estate markets, 10 additional indicators for other financial corporations such as insurance companies, pension funds and other money market funds, 7 for non-financial corporations. There are also 3 other indicators each for households and real estate markets. IMF currently compiles FSIs for over 150 countries.

The core set of indicators for deposit takers are related to capital adequacy, asset quality, earnings and profitability, liquidity and sensitivity to market risk. Other indicators focus on credit exposure, investment, foreign exchange risks, and more.

Financial soundness of Nepali BFIs

Financial soundness indicators, as explained earlier, help assess the health of financial institutions. It basically looks at solvency indicator – measured through capital adequacy ratios and asset quality, liquidity indicators – measured mainly through liquidity ratios and credit-to-deposit growth, and profitability indicators – measured through Returns on Equity and Return on Assets. Each of these indicators for Nepali banking sector is briefly discussed below.

Capital Adequacy

Capital Adequacy of the financial Institutions is measured through two indicators: Core Capital Adequacy Ratio (CCAR) and Capital Adequacy Ratio (CAR). While the former includes equity shares and promoter’s capital, the latter includes supplementary capital in the form of debentures and other reserves along with the shareholder’s money. Currently, three capital adequacy frameworks are in effect for BFIs in Nepal. Infrastructure Bank follows Capital Adequacy Framework 2018, commercial banks and national Level development banks follow Capital Adequacy Framework 2015, other B and C class financial institutions follow Capital Adequacy Framework 2007. There are different capital adequacy requirements for CAF 2015 and CAF 2007. Minimum capital adequacy ratio, without capital buffers, as per CAF 2015 is 8.5 percent. This ratio for CAF 2007 is 10 percent.

The financial institution that fails to meet the minimum capital adequacy ratio (excluding capital buffer requirements) are subject to Prompt Corrective Action (PCA) bylaws. Currently few development banks and finance companies have deficiency in capital adequacy and are undertaking corrective actions as per the PCA bylaws. Despite few of these instances, largely the banking industry is well capitalized and the capital adequacy ratio of BFIs is above the regulatory minimum. The concern in the recent years, however, is declining trend in capital adequacy ratios, which have decreased by around two percentage points over the past three years.

Asset Quality

Asset quality of the financial institution is measured by the level of non-performing loans (NPL), Higher non-performing loans indicate lower asset quality. NPLs of the banking sector in Nepal has increased substantially in the last three years, raising concerns . Despite this, NPL levels are still manageable. The provision standards that Nepal prescribes for loan and advances is relatively stringent and the data shows that Provision Coverage Ratio is almost 70 percent of the NPLs. This reduces net NPL to almost 30 percent of the gross NPL. Despite the lower net NPL figures, supervisory concerns remain about declining capital adequacy and increasing NPL levels.

Liquidity

Liquidity of the banking sector is assessed through the Net Liquid Assets (NLA) to Deposit Ratio. NLA includes cash balances of the financial institutions, their balances at Nepal Rastra Bank, their investment in government securities, short term placement and bank balance adjusted with short term borrowings. Currently the regulatory minimum for NLA ratio is 20 percent and the Banking industry is operating with excess liquidity. NRB is also introducing the concept of Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) in line with Basel III standards for BFIs in Nepal.

Profitability

Profitability of the banking sector is measured through Return on Equity (ROE) and Return on Assets (ROA). With the significant decline in these ratios in the last few years, the interest of the investors in the banking sector is fading. This decline is due to increased provisioning (linked to rising NPLs), reduced credit growth despite excess liquidity, and rising operational costs. Poorly planned branch expansions have also contributed to inefficiencies..

Soundness indicator of Nepali BFIs

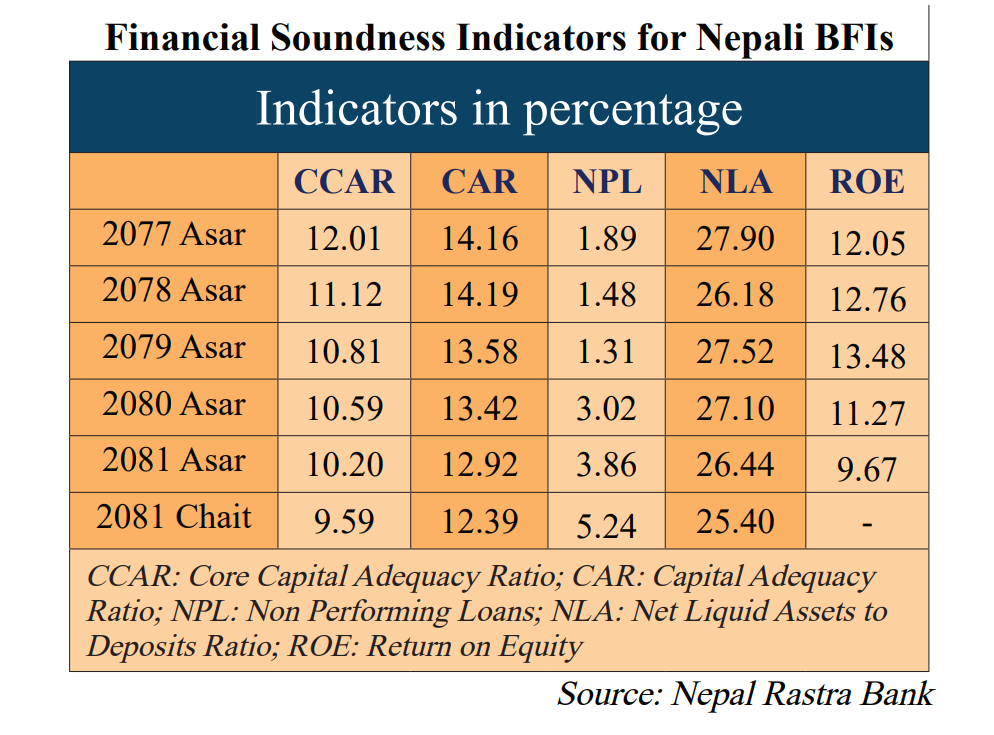

Financial Soundness Indicators of Nepali banks and financial institutions (Class A, B and C institutions combined) is presented in the following table.

As discussed in the previous section, solvency ratios have declined by more than 2.5 percentage points in the last five years. Further, return on assets has also fallen below 10 percent, down from over 12 percent within five years. This is mainly due to deteriorating asset quality as reflected in NPL level. In the last five years, NPL for the industry has increased to 5.24 in Chait 2081 from less than 2 percent five years ago. The liquidity ratio, however, is hovering around 26 percent in the last five years, well above the regulatory minimum.

Conclusion

Financial stability is a key mandate of Nepal Rastra Bank. Though it is a broad concept that requires coordinated approach between financial sector regulators and the government, Nepal Rastra Bank has a larger say, mainly because it regulates institutions with more than two third of the assets of the entire financial sector. Policies aim to ensure institutional soundness, and supervisory efforts have improved compliance and risk monitoring. Challenges persist due to declining capital adequacy, worsening asset quality, excess liquidity, weak credit demand, and falling profitability.

(Dr. Timilsina is Executive Director of Nepal Rastra Bank.)

प्रतिक्रिया